Roth ira contribution limit calculator

If you earn a taxable income you can open an account. You can even make contributions to your Roth IRA after you reach age 70½.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

Low contribution limitThe annual IRA contribution limit for the 2022 tax year is 6000 for those under the age of 50 or 7000 for those 50 and older.

. You can use our IRA Contribution Calculator or our Roth vs. You can contribute a total of 6000 to either your traditional or Roth IRA without exceeding the contribution limits if you were 49 years old or younger in 2022. You can contribute 100 of your taxable compensation up to the annual contribution limit.

You can actually do both as long as you dont exceed the contribution limit for that year. Keep in mind that the combined annual contribution limit always applies. The Roth IRA contribution limit is 6000 per year in 2022.

Roth IRA income requirements 2022. Retirement Calculator Investment Calculator Net Worth Calculator. A Roth IRA is a retirement account that lets your investments grow tax-free.

Your Roth IRA contribution also cant be more than 100 of your taxable compensation for the year. Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. Calculate your IRA contribution limit.

Solo 401k contribution calculation for a sole proprietorship partnership or an LLC taxed as a sole proprietorship. In comparison the 401k. Those under age 50.

Traditional IRA comparison page to see what option might be right for you. Total contribution limit to both Roth and traditional IRAs of up to 7000 Roth. If you were 50 or older by the end of 2021 you can contribute up to 7000 total.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution.

Contribution Limits for IRAs. In fact if you start contributing at a younger age you increase your earning potential once you decide to retire. The 2022 contribution limit for both traditional and Roth IRAs is 6000.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. Assuming you are allowed to make the maximum contribution and earn more than 60000 per year.

The IRS stipulates this so those nearing retirement can set aside a bit more. This limit applies across all IRAs. Modified adjusted gross income MAGI Contribution Limit.

Americans who are 50 or older can contribute an additional 1000 in catch-up contributions. Total contribution limit to both Roth and traditional IRAs of up to 6000 Those 50 or older. Your income also cant exceed the Roth IRA income limits.

Heres the lowdown on Roth IRA rules including contribution limits eligibility rules income phase-outs and withdrawal limits. Decide if you want to manage the investments in your IRA or have us do it for you. In 2022 youre ineligible to contribute if your income is greater than 144000 for single filers and 214000 for married couples filing a joint return.

The maximum allowable contribution to a Roth IRA in 2022 is just 6000 for those below the age of 50. The annual contribution limit for a traditional IRA in 2021 is 6000 or your taxable income whichever is lower.

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Earlyretirement Retirement Calculator Early Retirement Retirement

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Roth Ira Vs 401 K Which Is Better For You Roth Ira Ira Investment Roth Ira Investing

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Ira Comparison Roth Vs Traditional Ira Fidelity Roth Vs Traditional Ira Traditional Ira Ira

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

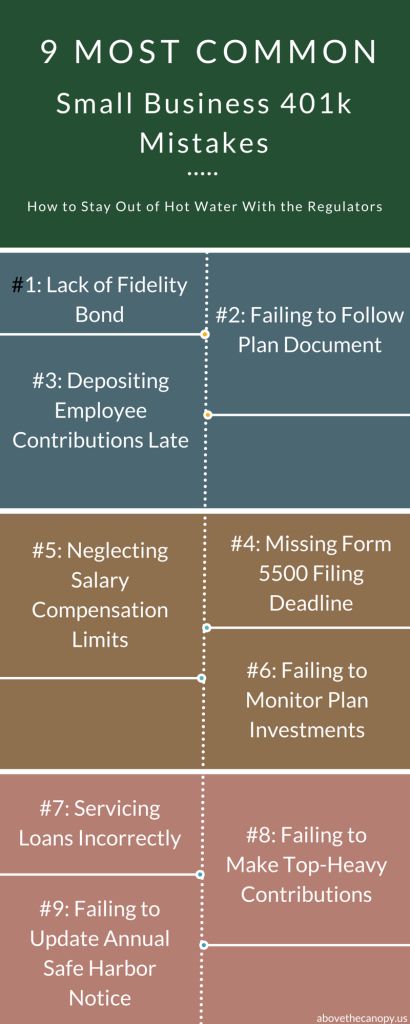

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

![]()

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

Pin On Usa Tax Code Blog

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Net Worth Calculator Personal Financial Statement Net Worth Event Planning Template

Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth Ira Roth Ira Contributions Traditional Ira

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes